Know who's ready to buy,and why

Real buying intent emerges over time as a pattern. We connect signals from across your stack into a complete, evolving view of who's moving toward readiness.

GTM teams miss high,value opportunities

Most targeting relies on outdated, static approaches. You have a list of companies that "fit" your ICP,but which ones are actually moving toward readiness right now?

- Static ICP metrics: industry, revenue, headcount don't tell you who's ready now

- Single signal triggers: one data point isn't enough to act on

- Generic intent scoring: not tailored to your specific solution

- Point,in,time data: no historical context of how accounts develop

Compounding market intelligence

We connect signals into a complete, evolving view of your market,updated continuously as new data emerges.

Ingest

Continuously scan signals from your CRM, website, email engagement, job boards, news feeds, and social activity.

Score

Apply your custom GTM logic to evaluate which signals matter most,tailored to your specific solution and ICP.

Surface

Rank and explain which accounts are showing the strongest signs of need,with full context of how they got there.

Most intent tools give you a point,in,time snapshot.

LeanGTM builds a compounding dataset,signals accumulate, historical comparisons become possible, and you see accounts moving toward readiness, not just who fits today.

See who's moving toward readiness,and why

It's not generic intent. It's your logic, applied continuously, with the full context of how each account develops over time.

Dynamic Prioritization

Accounts ranked by evolving signal patterns, not static criteria. See what changed, when it happened, and why it matters.

Evidence,Based Outreach

Every recommendation comes with the signals that triggered it. Reference their funding, hiring, or engagement with confidence.

Compounding Knowledge

Signals accumulate over time. Historical comparisons show which accounts are accelerating,not just who fits today.

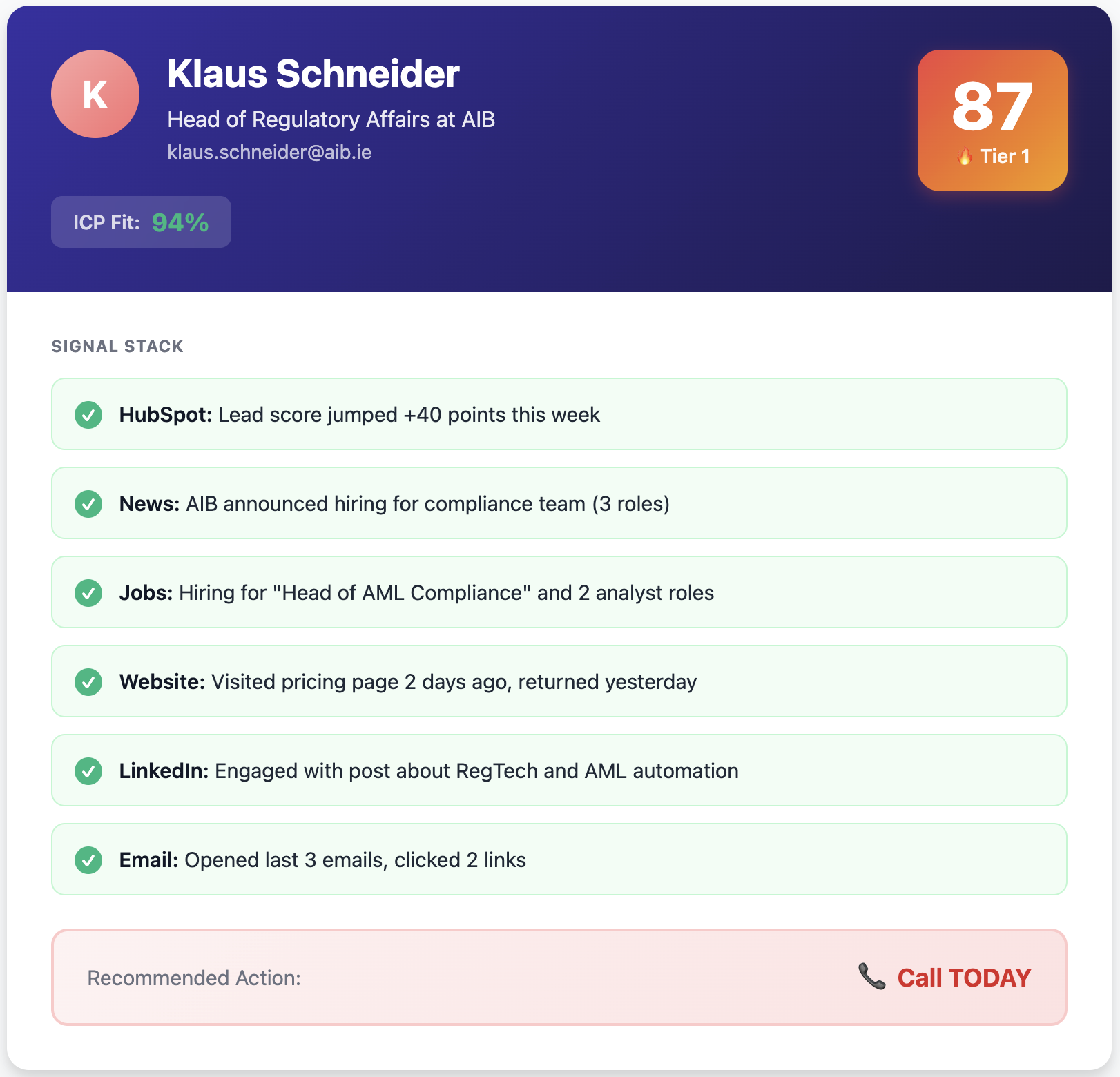

Prioritized leads with full context

Every lead comes with its signal stack,you know exactly why they're hot and what to say.

Where we find buying signals

We aggregate data from across your stack and the web to give you a complete picture.

CRM & Marketing

Engagement data, lead scores, and deal signals from your existing stack

Website Visitors

Companies visiting your website,de,anonymised and enriched

News & Events

Company events that indicate buying readiness

Job Signals

Hiring for roles you help with = budget allocated

Email & Social

Opens, clicks, replies, and social engagement

Technographics

Tech stack changes and tool usage

The Lead Intelligence Hierarchy

Not all leads are equal. Our tiered system automatically prioritizes based on signal strength, data richness, and relationship warmth.

Every signal has a score

We weight signals based on how predictive they are of buying intent. Scores decay over time,a pricing page visit from 2 days ago matters more than one from 2 months ago.

Stop guessing. Start knowing.

See how Lead Intelligence identifies your hottest prospects,and exactly what to say to them.

Book a demo